25 Nov Emerging Markets in the Beauty Industry: Case Studies and Strategies for Global Growth

As global beauty brands search for growth opportunities, emerging markets in the beauty industry like Southeast Asia, Africa, and Tier 2 cities in India and China have become vital areas for expansion. Rising disposable incomes and shifting consumer behaviors in these regions are driving significant increases in beauty spending. By adopting integrated campaigns tailored to local cultural nuances, brands can effectively capture market share in these high-potential markets.

Before delving into a detailed analysis of these regions, this article provides a visual overview through key charts illustrating disposable income growth, beauty spending trends, and market share distributions across emerging regions. These insights set the stage for a comprehensive textual exploration of the opportunities, success stories, and actionable strategies that are driving growth in emerging markets in the beauty industry.

1. Visualizing Opportunities in Emerging Beauty Markets

To provide a clear foundation for understanding the opportunities within emerging markets in the beauty industry, the following charts offer a visual representation of key data points. These include disposable income growth, beauty spending trends, and market share distributions across Southeast Asia, Africa, and Tier 2 cities in India and China. Together, these visuals highlight the economic and consumer behavior trends driving growth in the emerging markets in the beauty industry, setting the stage for deeper insights.

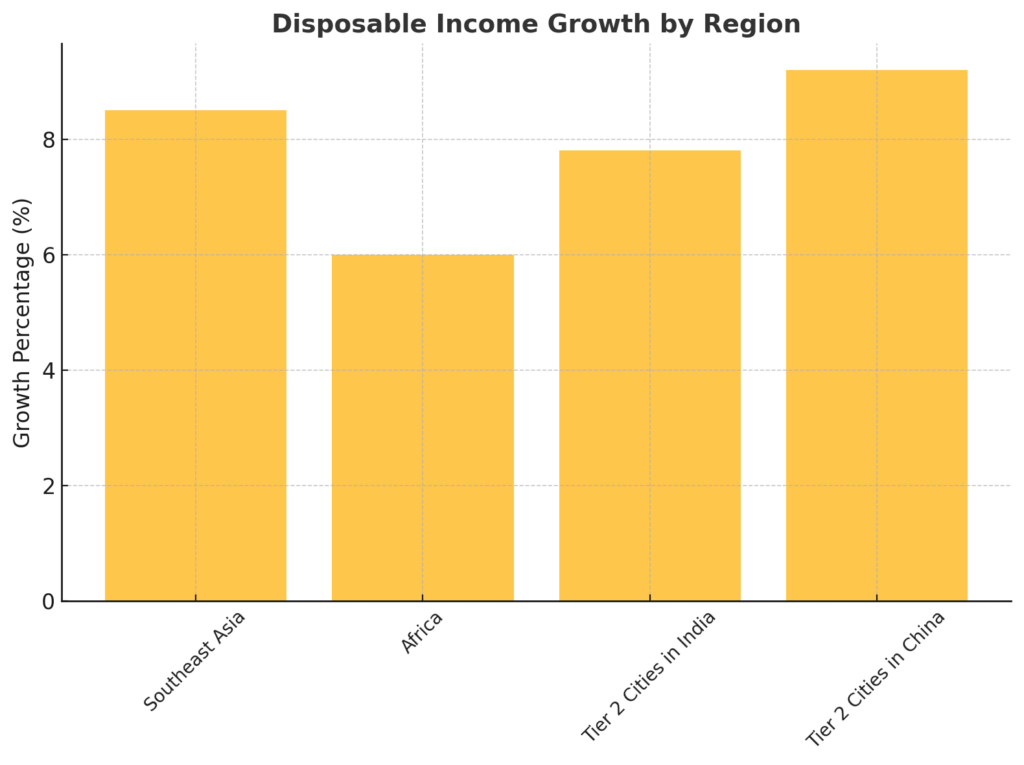

1.1 Disposable Income Growth by Region

-

- Data Source: Internal analysis by Amra & Elma using data from the World Bank’s “Global Economic Prospects 2024” and Statista’s “Regional Income Trends, 2024.”

- Description: This chart visualizes annual disposable income growth across Southeast Asia, Africa, Tier 2 cities in India, and Tier 2 cities in China, highlighting opportunities in emerging markets.

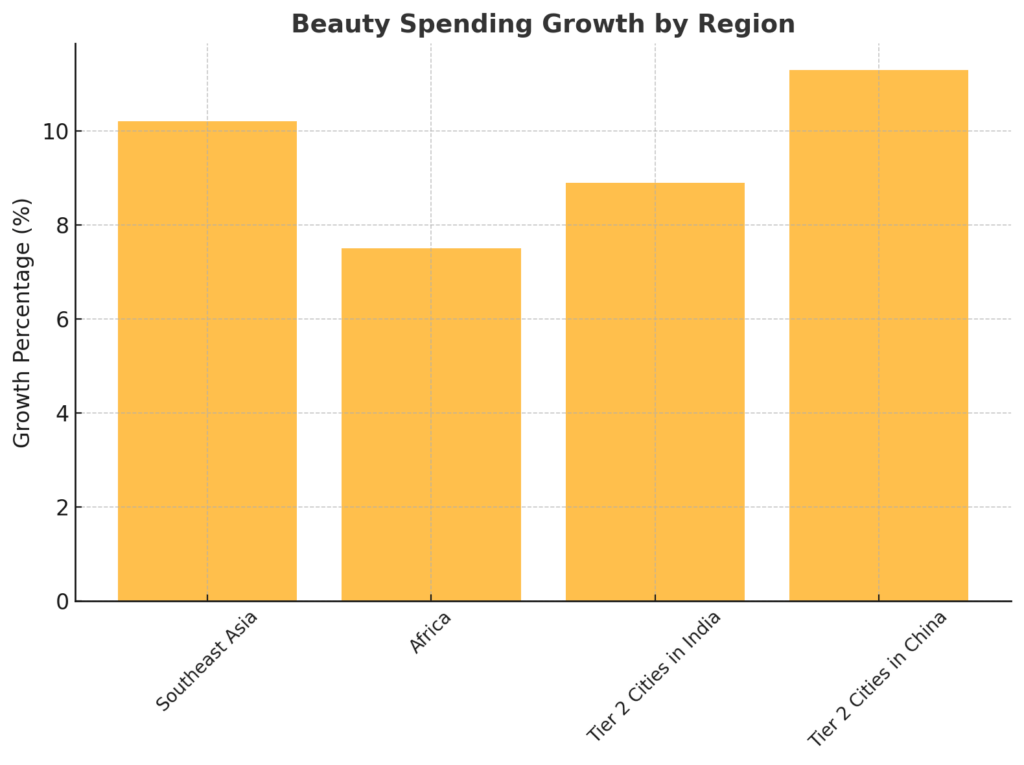

1. 2. Beauty Spending Growth by Region

1. 2. Beauty Spending Growth by Region

-

- Data Source: Internal analysis by Amra & Elma based on figures from L’Oréal’s “Annual Beauty Market Report 2023” and the African Development Bank’s “Consumer Spending Trends in 2024.”

- Description: A comparative look at the annual growth rates of beauty spending in emerging markets, showcasing the regions with the most promising demand increases.

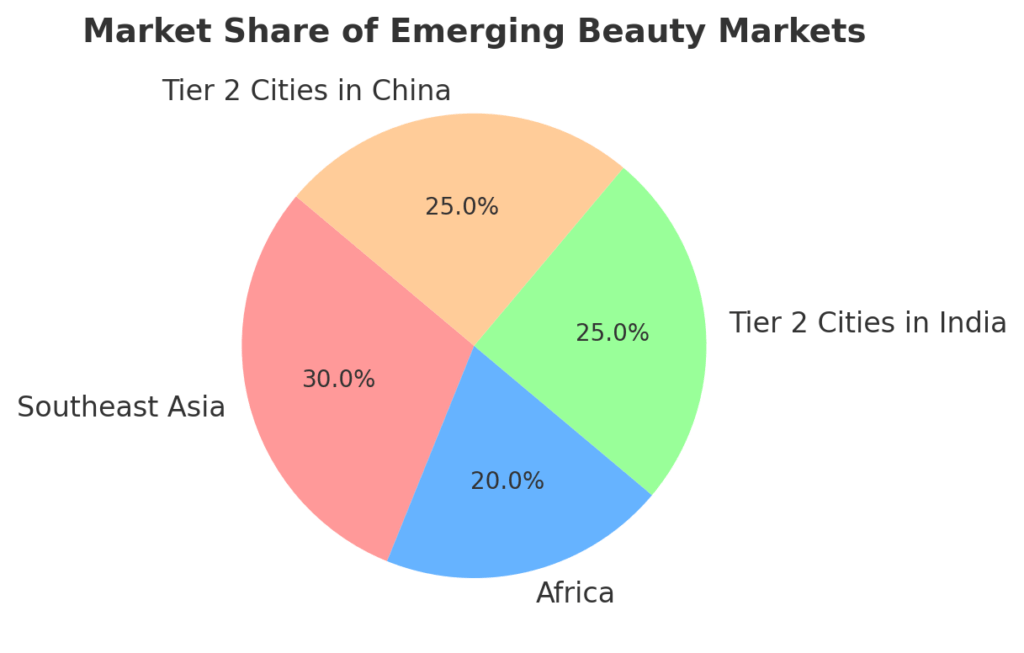

1. 3. Market Share of Emerging Markets in the Beauty Industry

1. 3. Market Share of Emerging Markets in the Beauty Industry

-

- Data Source: Amra & Elma proprietary analysis using aggregated data from Euromonitor International’s “Beauty and Personal Care Market Outlook 2024” and insights from local market surveys.

- Description: This pie chart illustrates the market share distribution across key emerging markets, emphasizing their contribution to the global beauty industry.

2. Unlocking Growth Through Regional Insights

2. Unlocking Growth Through Regional Insights

Building on the visual overview, the textual analysis dives deeper into the nuances of emerging markets in the beauty industry. It examines the factors contributing to their growth, such as rising disposable incomes, evolving consumer preferences, and the increasing demand for culturally tailored marketing. Through region-specific insights and case studies, the analysis provides actionable strategies for brands looking to establish or expand their presence in these high-potential markets.

2.1. Southeast Asia: A Key Player in the Emerging Markets in the Beauty Industry

Rising Disposable Incomes and Spending Patterns

Southeast Asia is a focal point for growth in the beauty industry. With countries like Indonesia, Thailand, and Vietnam witnessing an annual disposable income growth rate of 8.5% (source: World Bank, “Economic Outlook for Southeast Asia,” June 2024), the region is rapidly expanding. The emerging markets in the beauty industry in Southeast Asia are projected to exceed $25 billion by 2025, fueled by a young, digitally savvy population.

Consumer Trends in Southeast Asia

-

- Social Media Dominance: Platforms like TikTok and Instagram play a critical role in product discovery and purchasing.

- Skincare Obsession: Southeast Asian consumers prioritize skincare products with natural and sustainable ingredients.

How Amra & Elma Can Help Amra & Elma specializes in building data-driven, culturally relevant campaigns for the emerging markets in the beauty industry. By optimizing e-commerce visibility through Google Search trends and connecting brands with regional influencers, including experiential events, we ensure maximum resonance with the Southeast Asian audience.

2.2. Africa: A Rising Star in the Beauty Industry

Rising Disposable Incomes and Spending Patterns

Africa’s disposable incomes are rising at a rate of 6% annually (source: African Development Bank, “African Economic Outlook,” May 2024), with its beauty market valued at $13 billion. As one of the most promising emerging markets in the beauty industry, Africa’s demand for inclusive skincare and haircare products is accelerating.

Consumer Trends in Africa

-

- Inclusivity Matters: African consumers seek products that cater to diverse skin tones and hair textures.

- Mobile-First Economy: Mobile penetration drives e-commerce, with platforms like WhatsApp and Instagram dominating engagement.

How Amra & Elma Can Help Amra & Elma partners with beauty brands to create campaigns that reflect the local cultural diversity of emerging markets in the beauty industry. By leveraging local production talent, we create authentic, high-quality content tailored to African audiences, ensuring that global brands connect with consumers on a personal level.

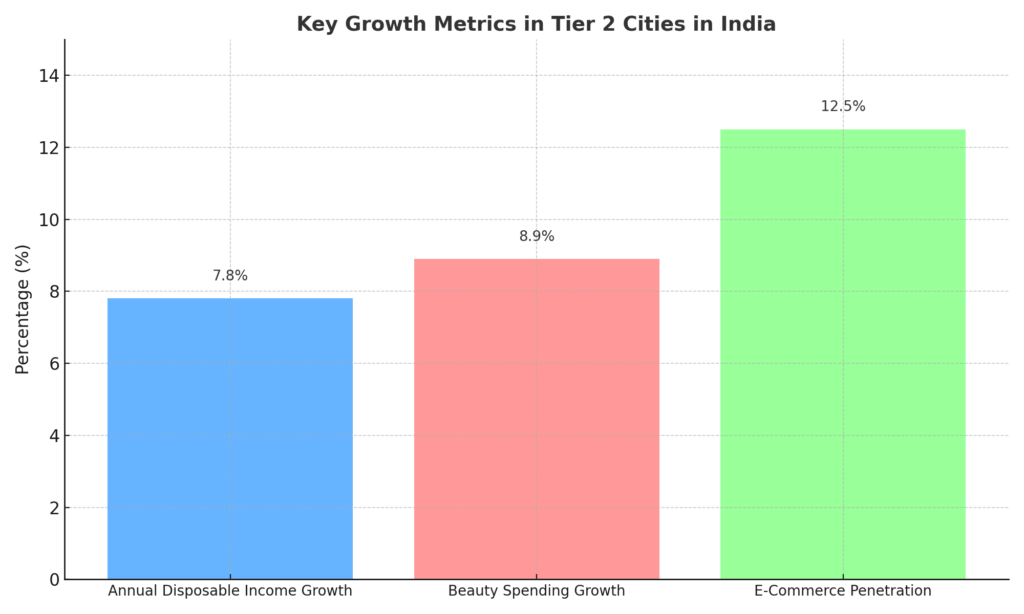

2.3. Tier 2 Cities in India: A Major Contributor to Emerging Markets in Beauty Industry

Rising Disposable Incomes and Spending Patterns

Tier 2 cities in India, such as Jaipur and Lucknow, are becoming key contributors to the growth of the emerging markets in the beauty industry. With an annual disposable income growth rate of 7.8% (source: Statista, “India’s Tier 2 Cities: Economic Growth and Consumer Trends,” April 2024), these cities are fueling demand for premium beauty products.

Consumer Trends in India’s Tier 2 Cities

-

- Aspirational Buyers: Consumers are heavily influenced by Bollywood trends and social media, seeking both premium and affordable beauty options.

- E-Commerce Boom: Platforms like Nykaa and Amazon India are leading beauty sales in these emerging markets in the beauty industry.

How Amra & Elma Can Help Our team at Amra & Elma leverages Google Search optimization to position beauty brands as leaders in India’s emerging markets in the beauty industry. By collaborating with influencers who understand local aspirations, we ensure that brands resonate deeply with consumers in Tier 2 cities.

2.4. Tier 2 Cities in China: A Burgeoning Market for Beauty

Rising Disposable Incomes and Spending Patterns

China’s Tier 2 cities, such as Chengdu and Hangzhou, are central to the expansion of emerging markets in the beauty industry. With disposable incomes rising by 9.2% annually (National Bureau of Statistics of China, “Households’ Income and Consumption Expenditure in 2023,” January 18, 2024), these cities are driving demand for luxury and skincare products.

Consumer Trends in Tier 2 Cities of China

-

- Luxury Aspirations: Consumers are drawn to premium beauty products as symbols of status.

- Tech-Savvy Shoppers: Platforms like WeChat, Tmall, and Douyin dominate the digital shopping experience.

How Amra & Elma Can Help Amra & Elma designs tailored marketing strategies for emerging markets in the beauty industry like China. By optimizing visibility on Baidu and collaborating with influential creators on Douyin, we position your brand to thrive in China’s rapidly growing Tier 2 cities.

2.5. Why Amra & Elma is the Perfect Partner for Emerging Markets in the Beauty Industry: Media Buying Expertise

2.5. Why Amra & Elma is the Perfect Partner for Emerging Markets in the Beauty Industry: Media Buying Expertise

At Amra & Elma, we bring unmatched expertise in media buying to help beauty brands effectively reach their target audiences in the emerging markets in the beauty industry. Our capabilities span local television advertising, radio advertising, billboards, and Google Ads, ensuring a multi-channel approach tailored to the unique dynamics of each market.

-

- Local Television Advertising: We collaborate with top-tier producers to create compelling television commercials, leveraging our deep network of talent casting agencies and local production experts to ensure campaigns resonate with diverse audiences. Our familiarity with local broadcasting channels ensures optimal ad placements for maximum visibility.

- Radio Advertising: Radio remains a powerful medium in many emerging markets. Our team designs engaging audio campaigns that connect with local listeners, tapping into their preferences and cultural nuances.

- Billboards and Outdoor Advertising: From high-traffic urban areas to regionally strategic locations, we craft impactful billboard campaigns that capture attention. Our connections with local media contacts ensure prominent placement and competitive pricing for outdoor advertising.

- Google Ads and Digital Campaigns: As certified experts in Google Ads, we create hyper-targeted campaigns that maximize ROI. We use localized strategies, including keyword optimization and region-specific audience segmentation, to ensure your brand appears at the top of search results.

Why Choose Amra & Elma for Media Buying?

Our global network of professionals includes industry-leading producers, casting agencies, and media contacts who deliver exceptional results. By combining their expertise with our strategic approach, we guarantee campaigns that not only capture attention but drive meaningful engagement and growth.

Whether through traditional media or digital platforms, our media buying services ensure your brand’s message is seen, heard, and remembered in every corner of the emerging markets in the beauty industry.

2.6. Emerging Markets in the Beauty Industry: Case Studies Driving Global Growth

The global beauty market is rapidly expanding, with emerging markets in the beauty industry becoming vital growth engines for major brands. These markets, including Southeast Asia, Africa, and Tier 2 cities in India and China, present unparalleled opportunities for brands to tap into rising disposable incomes, evolving consumer behaviors, and digital transformations.

Here are key case studies showcasing how leading beauty brands like L’Oréal, Estée Lauder, Coty, Unilever, and P&G have successfully unlocked growth in emerging markets in the beauty industry.

2.6.A. L’Oréal: Localization in China

-

- Challenge: Enter and compete in the rapidly evolving Chinese market.

- Strategy: L’Oréal capitalized on China’s digital-first consumer culture by collaborating with local influencers (Key Opinion Leaders or KOLs) and tailoring products for pollution-prone skin types. They also leveraged Tmall and WeChat to connect directly with consumers in Tier 2 cities.

- Result: L’Oréal China became the company’s second-largest market, growing at double-digit rates annually (source: Business of Fashion).

- Lesson for Emerging Markets in the Beauty Industry: Localization and partnerships with regional digital platforms accelerate growth in culturally diverse markets.

2.6.B. Estée Lauder: Targeting Tier 2 Cities in India

-

- Challenge: Expand beyond metro cities into Tier 2 and Tier 3 markets.

- Strategy: Estée Lauder partnered with local e-commerce platforms like Nykaa and Amazon India to enhance visibility in these regions. Additionally, they launched Bollywood-influenced campaigns to appeal to aspirational consumers.

- Result: Tier 2 cities contributed significantly to Estée Lauder’s online sales growth, making India one of its fastest-growing markets (source: Financial Express).

- Lesson for Emerging Markets in the Beauty Industry: E-commerce partnerships and culturally resonant campaigns are essential for engaging consumers in Tier 2 cities.

2.6.C. Unilever: Inclusivity in Africa

-

- Challenge: Address the demand for inclusive beauty products in Africa.

- Strategy: Unilever invested in developing inclusive product lines tailored to diverse skin tones and hair textures. They also collaborated with African influencers to amplify their reach and celebrate local beauty diversity.

- Result: Brands like Dove and Sunsilk captured significant market share in Africa, contributing to Unilever’s strong growth in the region (source: Unilever Annual Report).

- Lesson for Emerging Markets in the Beauty Industry: Inclusivity and culturally relevant storytelling are key drivers of success in Africa.

2.6.D. P&G: Digital-First Approach in Southeast Asia

-

- Challenge: Compete with regional and Korean beauty brands in digital-savvy markets like Southeast Asia.

- Strategy: P&G focused on hyper-personalized digital marketing across Instagram, TikTok, and Facebook. They also utilized e-commerce platforms such as Lazada and Shopee to gain consumer insights and refine their campaigns.

- Result: P&G’s sales in Southeast Asia grew by 15%, driven by skincare and grooming products (source: P&G Investor Report).

- Lesson for Emerging Markets in the Beauty Industry: Leveraging digital platforms and personalized marketing strategies enhances brand visibility in tech-driven regions.

2.6.E. Coty: Sustainability in Emerging Markets

-

- Challenge: Meet the demand for sustainable luxury in Tier 2 cities in China and Southeast Asia.

- Strategy: Coty highlighted the sustainability of brands like Gucci Beauty and Kylie Cosmetics, focusing on eco-friendly packaging and cruelty-free certifications. They partnered with local influencers to tell authentic stories about sustainability.

- Result: Coty’s luxury beauty segment reported strong growth, with enhanced brand loyalty in emerging markets (source: Coty Quarterly Earnings).

- Lesson for Emerging Markets in the Beauty Industry: Combining sustainability with luxury appeals to eco-conscious, affluent consumers.

2.6.F. Shiseido: Personalization in Tier 2 Cities

-

- Challenge: Differentiate in highly competitive Tier 2 cities in Japan.

- Strategy: Shiseido used AI-powered skin analysis tools to offer personalized product recommendations in-store and online. They also incorporated traditional Japanese beauty rituals into their marketing.

- Result: Shiseido achieved a 10% increase in domestic sales, driven by Tier 2 cities (source: Shiseido Annual Report).

- Lesson for Emerging Markets in the Beauty Industry: Personalization and heritage storytelling create deeper connections with consumers.

2.7. Key Takeaways for Brands Targeting Emerging Markets in the Beauty Industry

-

-

- Localization Matters: Tailoring products and marketing strategies to local preferences is essential for cultural resonance.

- Digital-First Strategies Win: E-commerce and social media platforms dominate in emerging markets, making them critical for growth.

- Inclusivity Drives Loyalty: Developing inclusive products for diverse needs ensures broader market penetration.

- Sustainability is a Must: Younger consumers in emerging markets demand eco-conscious products and practices.

- Personalization Boosts Engagement: Hyper-personalized experiences foster strong brand relationships.

-

2.8. Why Amra & Elma is the Perfect Partner for Emerging Markets in the Beauty Industry

At Amra & Elma, we specialize in helping beauty brands succeed in emerging markets in the beauty industry by combining global expertise with local insights. Here’s how we deliver value:

-

-

- Search Optimization for Local Reach:

We optimize brand visibility on search engines like Google, Baidu, and other regional platforms to ensure your products are discoverable in local markets. - Influencer Campaigns with Global Reach:

With access to over 800K influencers worldwide, we craft culturally relevant campaigns that resonate with diverse audiences, bridging global branding with local authenticity. - Culturally Tailored Content Creation:

By collaborating with top local production talent, we deliver high-quality, culturally relevant content that reflects the unique preferences and values of each region. - Integrated Marketing for Maximum ROI:

From social media to e-commerce and PR, we create seamless campaigns designed to deliver measurable growth.

- Search Optimization for Local Reach:

-

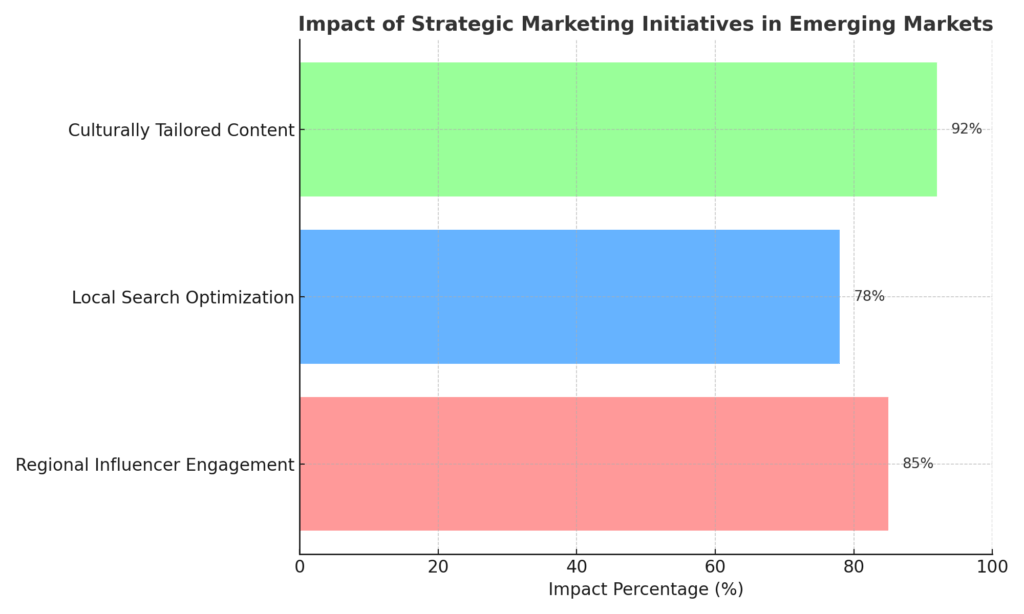

Drawing from our experience with globally recognized brands like Bvlgari and Nestlé, we excel at crafting campaigns that resonate across diverse markets. Core strategies—leveraging regional influencers, optimizing local search trends, and executing culturally tailored events—translate seamlessly to the demands of emerging markets in the beauty industry. With up to 10x ROI achieved for global brands, we demonstrate the ability to drive exceptional results in high-growth regions.

Expertise in Experiential Events:

Our team has extensive experience executing high-impact experiential events for global brands, including LVMH’s Bvlgari and Nestlé’s Acqua Panna. From Dubai to Bali, we’ve worked with media and influencers in emerging markets in the beauty industry to create unforgettable brand experiences that resonate deeply with target audiences, fostering stronger connections and elevating brand prestige.

This comprehensive approach ensures that beauty brands can not only enter emerging markets but thrive as leaders in these dynamic regions.

3. Conclusion: Shaping the Future of Beauty in Emerging Markets

The emerging markets in the beauty industry, including Southeast Asia, Africa, and Tier 2 cities in India and China, represent unparalleled opportunities for global beauty brands to achieve transformative growth. However, success in these markets demands a deep understanding of local cultures, evolving digital ecosystems, and consumer behaviors.

At Amra & Elma, we combine global expertise with localized insight to help beauty brands navigate the complexities of these high-growth markets. With our integrated marketing strategies, innovative digital solutions, and dedication to delivering measurable results, we ensure your brand not only enters these markets but thrives as a leader.

Let’s shape the future of your global brand together in the emerging markets in the beauty industry.Contact us to start building your success in the world’s most promising beauty markets.

Source: Internal analysis by Amra & Elma based on aggregated campaign performance data from global beauty clients in emerging markets, including insights from regional influencer engagement campaigns, local SEO initiatives, and culturally tailored content strategies.

Source: Internal analysis by Amra & Elma based on aggregated campaign performance data from global beauty clients in emerging markets, including insights from regional influencer engagement campaigns, local SEO initiatives, and culturally tailored content strategies.

This article was written by Elma Beganovich, partner in the New York office, see global press coverage of Amra & Elma.